Way back in the early days of this journal – May 16th 2012 to be precise – I posted to these pages an entry entitled “A Tough Occupation“. That was the first mention amidst this griffonage of a subject that was to become a major preoccupation over the following three years… my application for Permanent Resident status within Canada.

Should this subject be of the remotest interest to the gentle reader (you might perhaps be engaged upon a similar journey yourself) a subsequent post of May 20th 2015 – entitled “It’s Official!” – not only celebrated the eventual successful outcome of the application but also catalogued all of the prior posts on the subject. Useful – perhaps – should one wish to know just how the long and tortuous process can unfold.

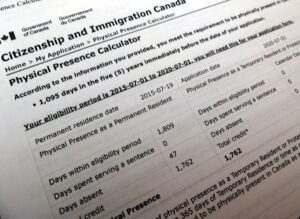

It will not take a degree in rocket science to deduce in short order the motivation for this particular post. It is – after all – exactly one week until the fifth anniversary of our ‘landing’ upon these shores – an occasion that is not without its implications, for once one has been a resident in Canada for five years one may – subject to a variety of other criteria – apply for citizenship. Needless to say this is something that I firmly intend to do.

There are – however – other important things to be addressed first.

I think I was vaguely aware that my Permanent Resident Card was only valid for five years, but in all the excitement of finally being here I did not look too closely at what would need to be done to extend that period. I made the naive assumption that all I would need to do would be to fill out some online application, pay a fee and a new card would rapidly pop into our mailbox.

Nothing so simple!

It turns out that another complex form must be completed (IMM 5444 (09-2019) E) – which demands details on everywhere one has lived since arriving, everywhere one has worked and everywhere one has traveled outwith Canadian borders. The fee must be paid and the receipt submitted, new photos must be taken (in the prescribed format) and signed appropriately by the photographer and copies of primary identification and existing PR card added to the submission. Once this has all been dispatched as directed one can sit back and await the delivery of one’s new card – in nine months time!

What?!

If this weren’t bad enough 2020 also happens to mark the tenth anniversary of my wedding to the Kickass Canada Girl. That is in itself, of course, a significant cause for celebration (on which more in subsequent posts) but another consideration arises therefrom. We took each other’s names when we married and that process entailed acquiring replacement passports. My UK passport thus expires at the end of this year and must also be renewed.

Now – a UK passport can reasonably easily be renewed from Canada (in this age of digital photography) by means of an online application – though the UK Passport Office do their level best to dissuade non-critical applications in these times of plague (presumably once it has become critical they would shrug their digital shoulders and suggest that the application should have been made sooner!). Anyway – I applied – not wanting to be without any means of moving between my birth and adoptive countries.

The problem is, however, that the UK Passport Office requires one to physically return one’s old passport before they will process the online application – thus surely rendering this modernised online version somewhat redundant. As a result one finds oneself worrying lacking in international documentation for an unspecified length of time…

…and I have not yet begun even to look at the citizenship application!

Sigh!

Recent Comments