“The beautiful journey of today can only begin when we learn to let go of yesterday”

“The beautiful journey of today can only begin when we learn to let go of yesterday”

Steve Maraboli

My last post to this journal ended with this sentence:

“Anyway – I feel that it will not be long until the news here, at least, takes a turn for the better“.

The very next day…

Quite enough has been written in these postings over the last ten months concerning our abortive attempt at a trip of a lifetime, featuring an all bells and whistles safari to Botswana. If you somehow missed the saga of how British Airways wrote off our epic adventure (along with a considerable chunk of our savings) then simply use the search feature on the home page. A search for “British Airways” or any one of a number of expletives should return the information that you seek.

Back in December – shortly before Christmas – this post brought regular readers up to date with the current status of our long (out)standing insurance claims – by means of which we hoped to recover at least some of our outlay. At that point (back in November) the girl had received a partial payment from our main insurers but I had heard nothing. The post ended thus:

“We must, of course, needs be patient yet and wait and see what happens…”

So – back to where we started:

The very next day…

…I received in the post a cheque from our insurers. It was for the full amount of the claim (actually by a small but discernible margin rather more than I was expecting).

Hoo-bloomin’-rah!

Delighted as she was for me, The Girl was understandably put out that she had been left out of this little bonanza.

However – the very next day (again!)…

…another missive arrived from the insurers, this time including a cheque for the residue of her claim.

Hoo-bloomin’-rah-some-more!

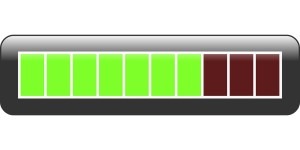

Where does this leave us? Well – all the claims that could be met and all the payments that the various parties could not avoid making – are in. We have, between the two of us, recovered something in excess of $24,000 (CAD). That might seem impressive had we not laid out just slightly less than $40,000 (CAD) on the trip and the recovery operation as a whole.

Well – we did get a (hugely expensive) week in the UK, though much of that time was spent either on the phone to British Airways or being unable to sleep because of a growing sense of panic.

No matter. ‘Tis over and done and we have all the closure we are going to get.

I promise that I will do my damnedest not to mention it again.

Recent Comments